(After finishing the article, I’ll generate a realistic horizontal image for it, then continue with the next one automatically until all 50 are done.)

Starting now…

How to Organize Your Personal Finances: A Beginner’s Guide

Managing your money effectively starts with organization. In this guide, you’ll learn practical strategies to set a budget, track spending, build an emergency fund, and lay the groundwork for future financial success.

Why Financial Organization Matters

Starting on firm financial footing helps you:

- Gain control of your money instead of letting it slip through your fingers.

- Set and pursue goals: emergencies, travel plans, investments.

- Reduce stress and avoid living paycheck-to-paycheck.

- Prepare for future growth, like investing or debt-free living.

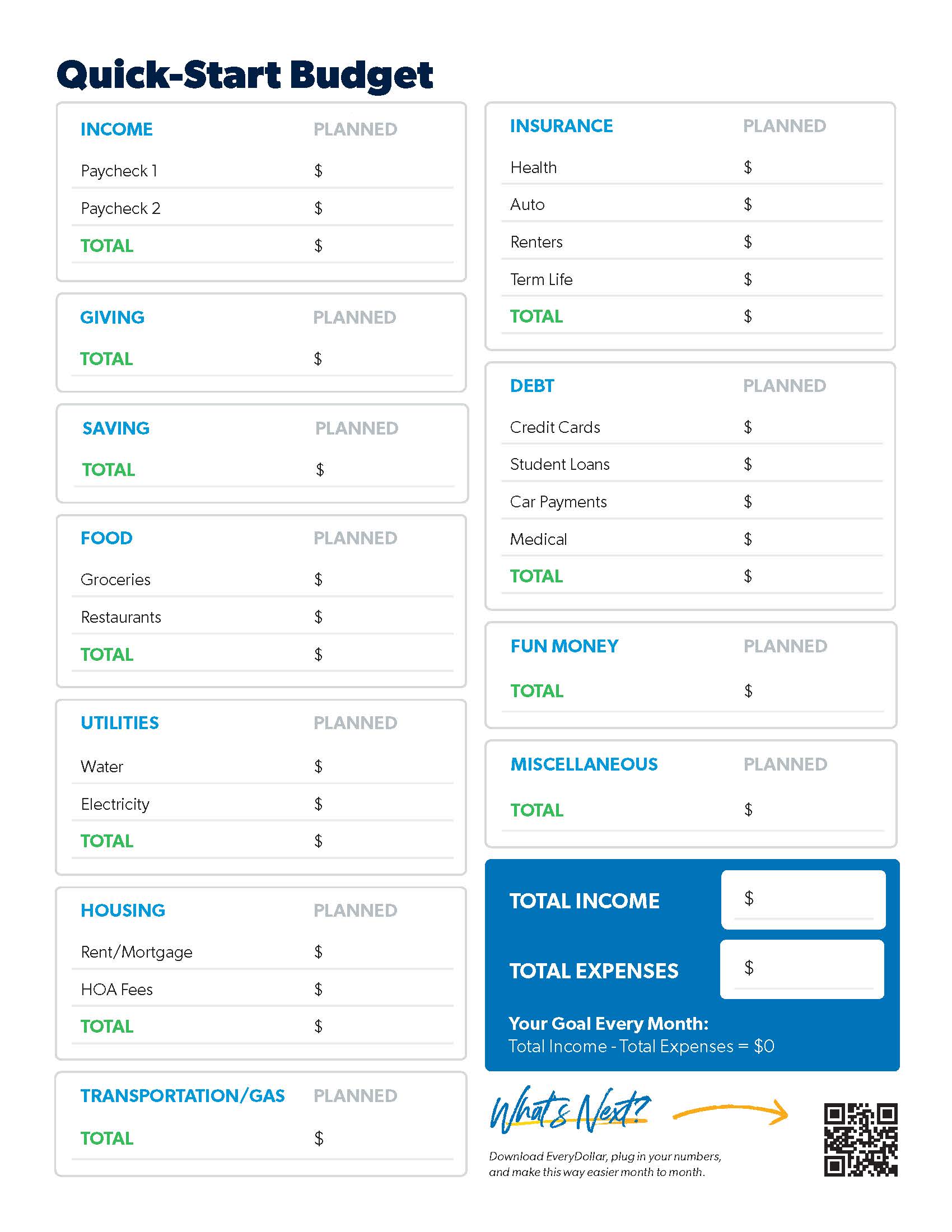

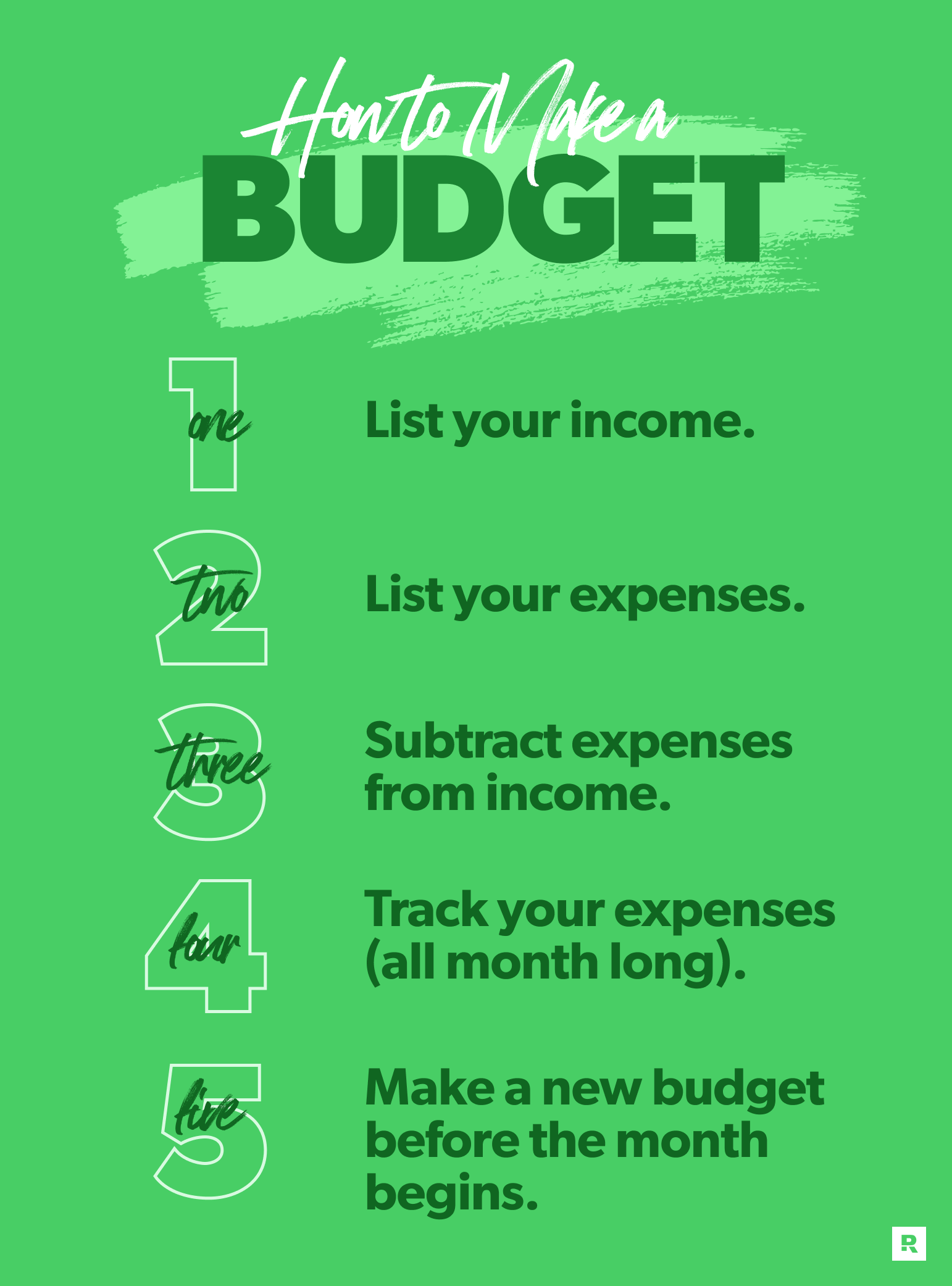

Step 1: Calculate Your Income and Expenses

- List all income sources: salary, side hustles, tips, dividends adobe.com+6ramseysolutions.com+6ramseysolutions.com+6sofi.comppcexpo.com.

- Detail your expenses: fixed (rent, insurance) and variable (groceries, streaming).

- Include occasional costs like semiannual car insuranceppcexpo.com+4ramseysolutions.com+4clockify.me+4sofi.com.

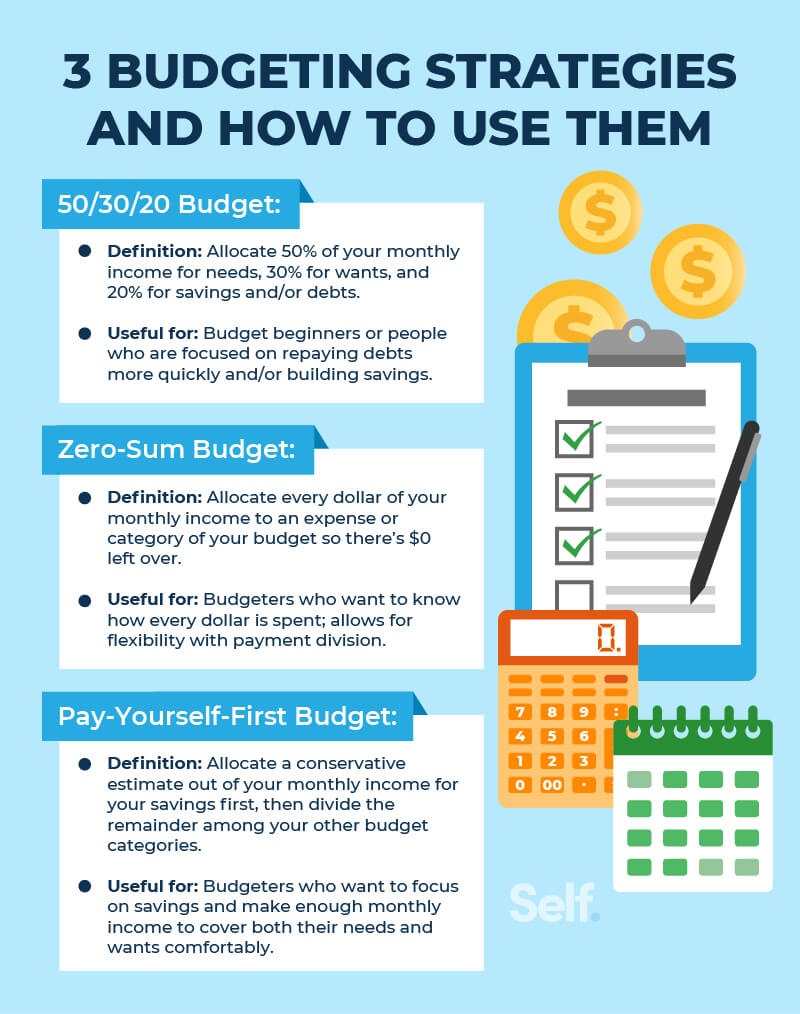

Step 2: Choose a Budget Framework

Popular methods:

- Zero-based budgeting: allocate every dollar of income until reaching zeroramseysolutions.com+2ramseysolutions.com+2sofi.com+2.

- 50/30/20 rule:

- 50% for needs, 30% for wants, 20% for saving/debtcleanandscentsible.com+9sofi.com+9self.inc+9.

- Envelope system: assign cash to categories and spend only what’s in each envelopesofi.com.

Choose a method that matches your style—paper, spreadsheet, or budgeting app.

Step 3: Track Every Transaction

- Record expenses immediately—weekly or daily.

- Compare planned vs actual spending to understand habits and avoid setbackssofi.com+8ramseysolutions.com+8ramseysolutions.com+8.

- Adjust your plan monthly based on actual outcomesramseysolutions.com+8ramseysolutions.com+8sofi.com+8.

Step 4: Build an Emergency Fund

- Aim for at least 3–6 months of essential expenses put aside.

- Fund it online or via automatic transfers for safety and ease.

Step 5: Review and Adjust Monthly

- At month’s end, check where you overspent or underspent.

- Plan the next month’s budget before it startsideallysheets.com+6ramseysolutions.com+6ramseysolutions.com+6.

- Include seasonal or annual expenses (e.g., holidays, insurance).

Step 6: Start Planning for the Future

With a steady budget and emergency fund, you can:

- Pay off debt using methods like debt snowball or avalanche.

- Start investing: user apps or platforms that suit beginners.

- Set financial goals: retirement, home purchase, dream vacation.

Bringing It All Together

Organizing your finances is not a one-time event—it’s a habit.

- Quantify your income and expenditures.

- Select a budgeting approach.

- Track regularly.

- Adjust monthly.

- Save for emergencies and future goals.

Stick with this process steadily, and you’ll build confidence, reduce financial stress, and pave the way toward stable and healthy financial living.